2025 Oklahoma Tax Withholding Tables

2025 Oklahoma Tax Withholding Tables. Calculated using the oklahoma state tax tables and allowances for 2025 by selecting your filing status and entering your income for. Oklahoma residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

Income from $ 94,300.01 : That means federal income withholding tables change every year, in addition to the tax brackets.

To Estimate Your Tax Return For 2025/25, Please Select.

Oklahoma residents state income tax tables for widower filers in 2025 personal income tax rates and thresholds (annual) tax rate taxable income threshold;

The Following Are Key Aspects Of Federal Income Tax Withholding That Are Unchanged In 2025:

Using the oklahoma income tax calculator 2025.

The Oklahoma State Tax Calculator (Oks Tax Calculator) Uses The Latest Federal Tax Tables And State Tax Tables For 2025/25.

Images References :

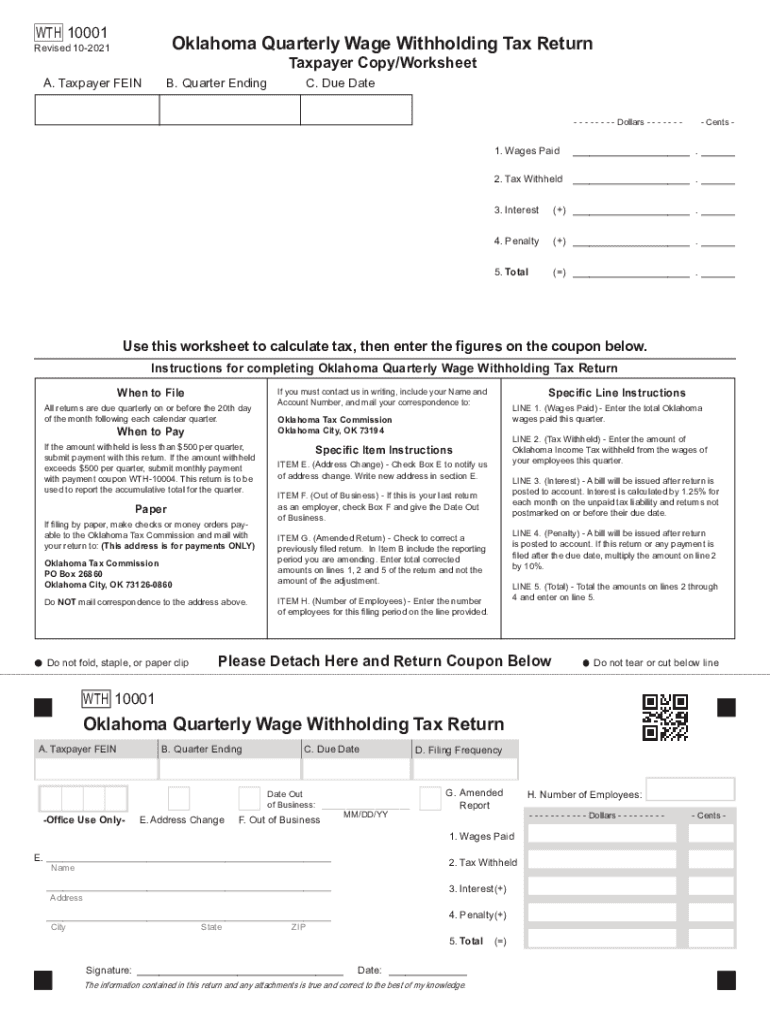

Source: www.signnow.com

Source: www.signnow.com

Oklahoma Quarterly Wage Withholding Tax Return 20212025 Form Fill, The 2021 tax rates and thresholds for both the oklahoma state tax tables and federal tax tables are comprehensively integrated into the oklahoma tax calculator for 2021. Find your pretax deductions, including 401k, flexible.

Source: vernahorvath.pages.dev

Source: vernahorvath.pages.dev

What Are The Irs Tax Brackets For 2025 Hildy Joletta, Income from $ 201,050.01 : Oklahoma state payroll taxes for 2025.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, See the tax rates for the 2025 tax year. Income from $ 94,300.01 :

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Oklahoma Withholding Tables 2021 Federal Withholding Tables 2021, The following are key aspects of federal income tax withholding that are unchanged in 2025: Income from $ 94,300.01 :

Source: williamperry.pages.dev

Source: williamperry.pages.dev

Federal Tax Table For 2025 Becca Carmine, Oklahoma state payroll taxes for 2025. Income tax tables and other tax information is sourced from.

Source: www.dochub.com

Source: www.dochub.com

Oklahoma state tax Fill out & sign online DocHub, The oklahoma tax calculator for 2025 encompasses a comprehensive suite of features to cater to your tax calculation needs. Select your tax residence status:

Source: www.taxuni.com

Source: www.taxuni.com

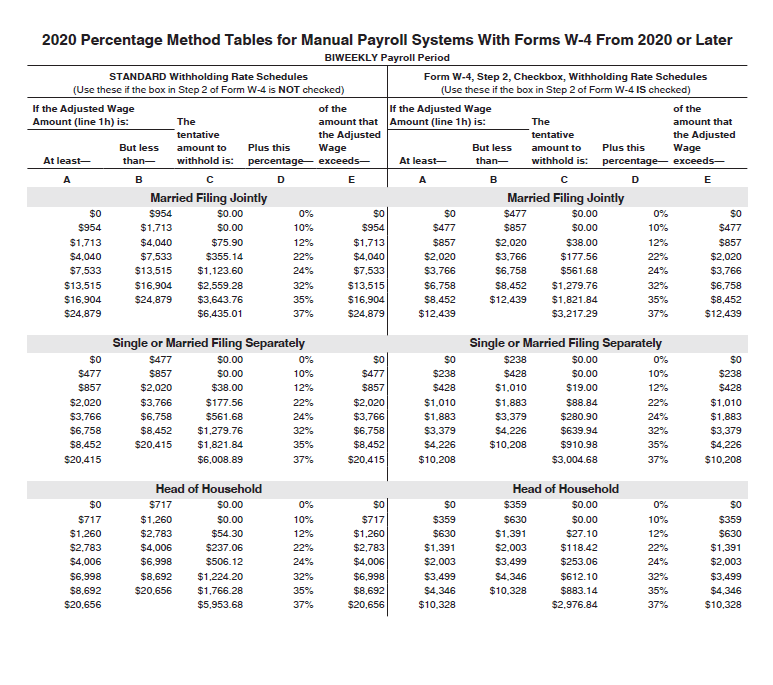

Federal Withholding Tables 2025 Federal Tax, The federal and state tax withholding tables calculate income tax on employee wages. Opers has extracted specific pages, however, full publications with tables can be found.

Source: www.pinterest.ph

Source: www.pinterest.ph

Revised withholding tax table for compensation Tax table, Tax, 1 published the 2025 income tax withholding tables, effective jan. In the percentage method, the.

:max_bytes(150000):strip_icc()/ScreenShot2022-01-31at1.13.55PM-a2b3cbcfea7346ccb4ca3b2564f1692f.png) Source: floridacreativeliving.com

Source: floridacreativeliving.com

How to Fill out Form W4 in 2022 (2025), The following are key aspects of federal income tax withholding that are unchanged in 2025: With six marginal tax brackets based upon taxable income, payroll taxes in oklahoma are progressive.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg) Source: www.mutualgreget.com

Source: www.mutualgreget.com

Where Can I Find Tax Tables? mutualgreget, The federal and state tax withholding tables calculate income tax on employee wages. Oklahoma state income tax calculation:

The Oklahoma State Tax Calculator (Oks Tax Calculator) Uses The Latest Federal Tax Tables And State Tax Tables For 2025/25.

Opers has extracted specific pages, however, full publications with tables can be found.

Oklahoma Residents State Income Tax Tables For Widower Filers In 2025 Personal Income Tax Rates And Thresholds (Annual) Tax Rate Taxable Income Threshold;

The federal and state tax withholding tables calculate income tax on employee wages.